Will Hale asks if the siloed nature of advice is constraining the equity release market rather than protecting or better, enhancing it?

For most people paying to protect the things they love and cherish is a normal part of everyday life but in the later life lending (LLL) market the focus can be on cost over quality, safeguards and appropriateness.

So why is it different in this market and how might advisers choose to approach these conversations with their clients?

Perhaps, we need to start by pausing for a moment and considering the protections offered by the three main mortgage products in the LLL market - equity release (ER), retirement interest-only mortgage (RIO) and standard mortgages - and then consider which one provides the highest degree of consumer protection.

Setting any perceived reputational issues aside, if you consider the amount of protection provided then I think we’d all conclude that ER is the safest product. No other product provides protection against rate rises, repossession and equity erosion. Equally, no other product can guarantee an inheritance for the borrowers’ family.

So, with that in mind, it seems reasonable that the product that provides the most protection might cost more. But in ER's case, that might not be true either.

Let’s take a situation where Sarah – aged 70 - who has divorced needs to borrow £50,000 to pay her former husband for his share of their £285,000 property.

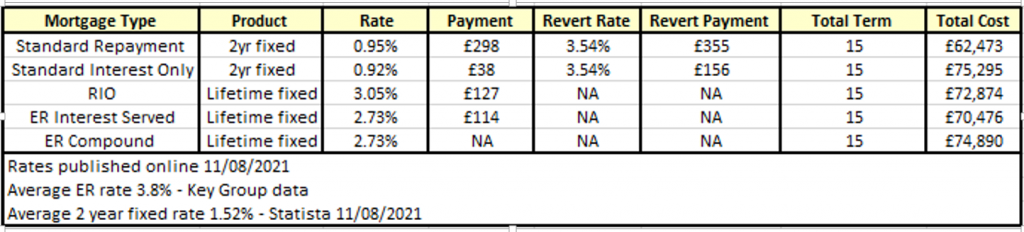

While she is retired, she has a healthy defined contribution pension which provides an income so could conceivably choose between any product in the later life lending universe. How would the costs compare if Sarah was to survive for 15 years?

Now, while the repayment mortgage is cheaper over the term than the other options, it comes with the highest monthly cost, rate protection which only lasts two years and carries a risk of repossession. On this basis, is it right to consider that the lower overall cost of that product also comes with a higher degree of risk?

On the flip-side the compounding ER plan is the most expensive over 15-years but has the lowest monthly cost and the highest level of protection so should that be considered the least risky product?

When you consider the protections and associated costs in that way I think it shines a fascinating light on the whole topic of later life product suitability. In my view, it also illustrates how important it is for borrowers to get the right specialist advice rather than trying to navigate through these options themselves.

Now, the eagle-eyed amongst you will have noted a few things.

Firstly, yes the ER rate is low, but I’ve also used low rates in the other markets so that feels fair. Secondly, the impact of the revert rate on the standard mortgage payments is quite significant, you’ll also wonder why I’ve assumed that the borrower won’t just remortgage at the end of each two-year product period. So let’s run that scenario as well.

If we assume a new standard product every two years will come with an about £950 lender arrangement fee and conservative initial advice cost of about £750, we can add an additional c£7,400 to the overall standard mortgage cost.

That doesn’t include any remortgage advice costs, nor any legal fees or any other lender incurred charges at the remortgage points.

We could, therefore, argue that the cost of protecting against rate increases is at least an additional £7,400 over the whole product term – offset of course by any saving made by switching rate, but also potentially subject to an increase in payments as a result of any rate rise.

If the borrower didn’t want to take those risks and instead elected for a fixed for life option (ER or RIO for example) requiring only one advice fee across the whole mortgage term, then the advice and product costs would likely be around £1,500, a saving of nearly £6,000 when compared to the cost of securing a new rate every two years.

So again which provides the better option? The strategy that looks to secure the lowest rate but comes with higher costs of advice and product fee’s (over the total term) or the strategy that elects for a higher initial advice fee but no pressing need to remortgage.

As usual, I’m not saying product A is better than product B or that adviser A does a better job than adviser B but in my view given the rate, protections and flexible payment options shouldn’t ER be considered more regularly rather than as a last resort?

Including product switching, the LLL market is estimated to be somewhere between £50bn - £100bn, so the c£4bn that is being written on ER feels very light.

Is there a chance that the siloed nature of the advice is constraining the ER market rather than protecting or enhancing it?

Affordability

Lastly, we all need to look at the take-up of products in this market and ask ourselves why we can’t find a better solution to the challenge of affordability.

RIO’s are more expensive, less flexible and offer less protection than modern ER, but they clearly fulfil a need.

Customers who have higher LTV requirements and can evidence affordability should still be able to benefit from the protections ER can provide them. Why should we ask them to evidence that they can afford a mortgage once they’ve retired when they don’t have to, can in fact stop making mandatory payments and have a whole range of additional embedded protections at less cost!

Before we can be sure of a recommendation we must first ensure we’ve considered all of the options!

Will Hale is CEO at Key