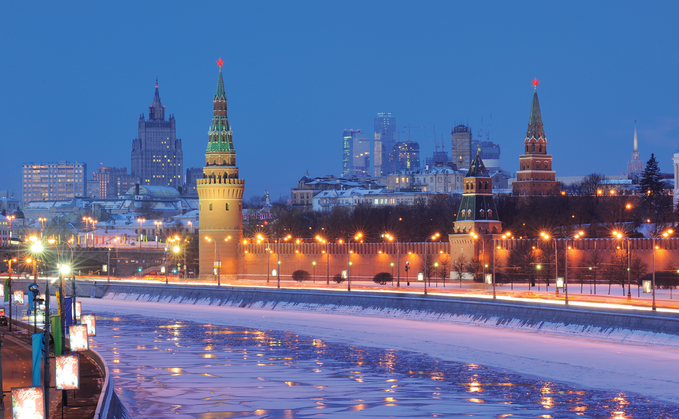

Quilter explained that the decision was made due to the Russian invasion of Ukraine and to “help protect client investments through a period of uncertainty”.

Quilter Investors has barred third-party managers from investing in Russia or Belarus on the firm’s range of sub-advised funds.

While the firm's sub-advised funds can continue to hold exposure to Russia and Belarus, they will no longer be able to increase existing holdings in any company listed or located in the countries.

The ban extends to any directly held security issued by a company, bank, public entity or government, as well as indirectly held exposure, such as derivatives.

Quilter added that it will "continue to engage with the managers where there are existing exposures, which are minimal, about how they plan on handling these."

The sub-advised funds are controlled by various asset managers appointed by Quilter Investors and are used in the firm's WealthSelect model portfolio service.

Quilter explained that the decision was made due to the Russian invasion of Ukraine and to "help protect client investments through a period of uncertainty".

Ukraine crisis video special: Investment panel respond to key questions for clients

Stuart Clark, portfolio manager at Quilter Investors, said: "Historically we have given our managers the autonomy to invest as they wish, provided they stick to the investment objective and policy and follow the philosophy and process that they were originally selected for.

"However, given the seriousness of the situation, we have a responsibility to act as stewards of our client's capital and as such we have taken the decision to implement a ban on the purchasing of Russian and Belarusian bonds or equities. There is no circumstance or valuation case for these securities to be part of a portfolio.

"Clearly the humanitarian crisis and the fate of the Ukrainian people is what matters most at this stage, but it is important our assets do not help contribute further to the barbaric acts that are being committed. We will keep a close eye on the situation and continue to engage with our managers to ensure client money is invested in a way that is responsible."