In November 2020, as positive news was breaking on vaccine efficacy, equity markets were slow to grasp the significant prospect of reopening economies. They have since caught up, but continue to underestimate the global economic growth potential for 2021 and 2022.1

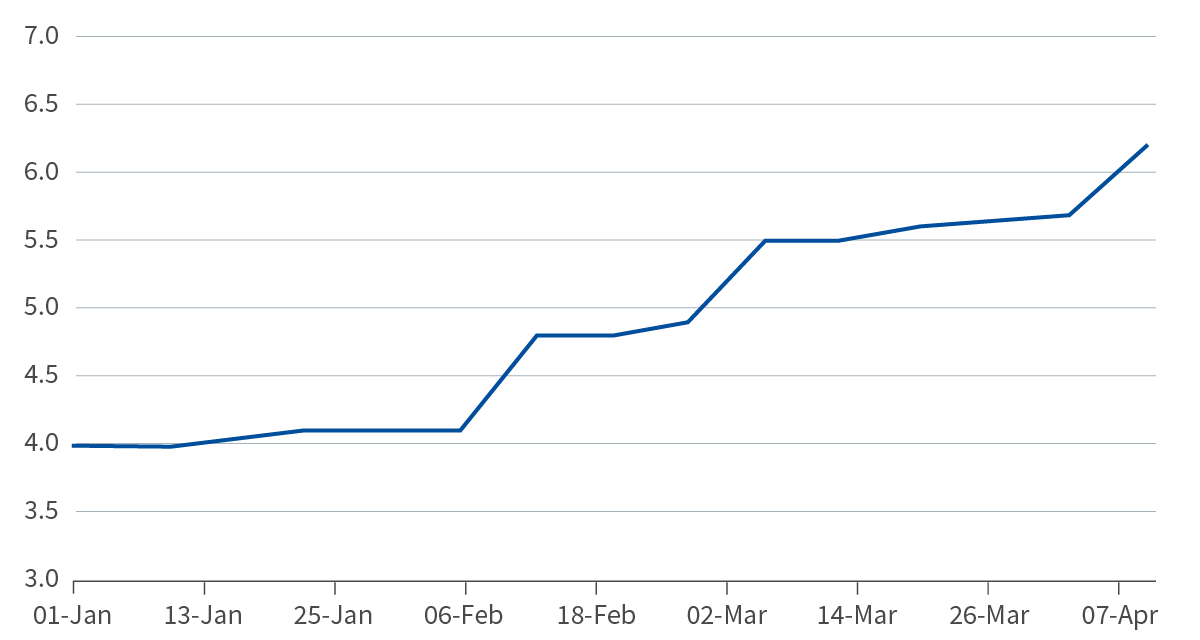

For example, the US Federal Reserve (Fed) raised its US growth forecast for 2021 from 4.2 per cent in December - when our estimates were already above six per cent - to 6.5 per cent in March. This is a significant change for a central bank.2 Published sell-side consensus has risen accordingly, yet risks remain tilted to the upside.

Figure 1: Bloomberg economist consensus for 2021 US real GDP growth (year-on-year, per cent)

Markets remain too pessimistic on growth

Two key areas might drive upside risks, in the US and China respectively. First, while the size of US fiscal stimulus is broadly understood and discounted, it is more difficult to assess the willingness to spend of individuals and companies. The private sector has built up large savings over the past year and could release a meaningful amount as the US economy reopens. Market forecasts do not yet fully account for this, most assessments conservatively discounting pre-pandemic levels of spending and not much more.3

References

- ‘House View Q2 2021', Aviva Investors, April 8, 2021

- ‘US economy to grow faster than forecast, says Federal Reserve', BBC News, March 17, 2021

- ‘The world's consumers are sitting on piles of cash. Will they spend it?', The Economist, March 13, 2021

Important Information

Except where stated as otherwise, the source of all information is Aviva Investors Global Services Limited ("Aviva Investors"). Unless stated otherwise any opinions expressed are those of Aviva Investors. They should not be viewed as indicating any guarantee of return from an investment managed by Aviva Investors nor as advice of any nature.

The value of an investment and any income from it can go down as well as up. Investors may not get back the original amount invested.

The Aviva Investors Multi‐asset Funds comprise two ranges, each with five funds (together the "Funds"): Aviva Investors Multi-asset Plus Fund range comprises the Aviva Investors Multi‐ asset Plus Fund I ("MAF Plus I"), the Aviva Investors Multi‐asset Fund Plus II ("MAF Plus II"), the Aviva Investors Multi‐asset Plus Fund III ("MAF Plus III"), the Aviva Investors Multi‐asset Plus Fund IV ("MAF Plus IV") and the Aviva Investors Multi‐asset Plus Fund V ("MAF Plus V"). Aviva Investors Multi-asset Core Fund range comprises the Aviva Investors Multi‐ asset Core Fund I ("MAF Core I"), the Aviva Investors Multi‐asset Fund Core II ("MAF Core II"), the Aviva Investors Multi‐asset Core Fund III ("MAF Core III"), the Aviva Investors Multi‐asset Core Fund IV ("MAF Core IV") and the Aviva Investors Multi‐asset Core Fund V ("MAF Core V").

The Funds are sub‐funds of the Aviva Investors Portfolio Funds ICVC. For further information please read the latest Key Investor Information Document and Supplementary Information Document. The Prospectus and the annual and interim reports are also available on request. Copies in English can be obtained free of charge from Aviva Investors UK Fund Services Limited, St Helen's, 1 Undershaft, London EC3P 3DQ. You can also download copies from our website.

Issued by Aviva Investors UK Fund Services Limited. Registered in England No 1973412. Authorised and regulated by the Financial Conduct Authority. Firm Reference No. 119310. Registered address: St. Helen's, 1 Undershaft, London, EC3P 3DQ. An Aviva company. 184850 - 12/04/2022