Key points

- US inflation data exceeded expectations in August.

- The European Central Bank has hit its terminal rate1, in our view.

- UK policymakers faced with strong inflation and wage growth, rising unemployment and falling economic output.

- Tentative signs that China's economy is beginning to recover.

Rate hikes look likely in the US and UK as high inflation persists, while the euro area has likely reached its terminal rate and China's economic woes may have hit a bottom.

United States - Although inflation data exceeded expectations in August, we don't see the inflation trend rising much higher and maintain our year-end expectations for US growth, rates and inflation.

We think either a rate hike or hold is plausible at the Federal Reserve's (Fed's) next policy meeting on 20 September and that the US central bank's policy rate will peak between 5.5% and 6% by the end of the year. The Fed's current rate target is in a range of 5.25%-5.5%, which is a 22-year high.

The US consumer price index (CPI) was 3.7% in August compared with a year earlier, up from 3.2% in July, driven largely by a rise in petrol prices, which rose 10.6% compared with July. Core CPI, which excludes volatile food and energy prices, rose by 0.28% compared with July, slightly higher than our expectations for a 0.25% rise and above the pace of the two previous months.

Despite the rise in both headline and core CPI, shelter-related inflation continued to trend lower, goods prices have been deflationary, and—outside of volatile transportation prices—services prices have been largely within expectations. We still expect year-on-year headline CPI of 3.2% and core CPI of 3.6% to end 2023.

Unemployment rose to 3.8% in August, but we don't see this rising further before year-end. We maintain our 1.8% growth forecast for 2023 and our base case is for a recession within the next 18 months.

Euro area - We think the monetary policy tightening that started in July 2022 will have its maximum impact in the next two quarters and that the European Central Bank (ECB) has now reached its terminal rate.

Having raised its deposit facility rate to 4.0% at its 14 September meeting, we now believe the ECB will leave rates on hold until at least the middle of 2024.

Headline inflation remained at 5.3% in August compared with a year earlier. Services inflation eased only modestly year-on-year, to 5.5% from 5.6%, and core inflation, which excludes energy, food, alcohol and tobacco prices, came down to 5.3% in August from 5.5% in July. We expect a sharp disinflationary trajectory for the remainder of 2023, with core inflation ending the year at around 3.3%.

We remain sceptical about the prospect for painless disinflation and see the unemployment rate rising before year-end. Vanguard expects the euro area economy to contract in the third and fourth quarters of 2023.

United Kingdom - Mixed labour market data, strong inflationary pressures and signs of economic weakness put the Bank of England (BoE) in a tricky spot ahead of its 21 September meeting.

We believe the bank will announce a further 25-basis-point increase at its September meeting and we hold our terminal rate expectation of 5.5%-5.75%. That said, there is a risk that persistently strong wage and inflation data could see the bank rate go even beyond our terminal rate forecast.

UK headline inflation increased by 6.8% in July compared with a year earlier, lower than 7.9% in June but still well above the central bank's target level of 2%. Core inflation, which strips out alcohol, tobacco, food and energy prices, rose 6.9% year-on-year. Services inflation rose from 7.2% to 7.4% year-on-year. Vanguard expects both headline and core inflation to fall to close to 5% by the end of 2023.

Wage growth remained hot, with private sector pay (excluding bonuses) rising 8.1% during the three months ending 31 July, compared with the same period in 2022. At the same time, employment levels fell and job vacancies dropped below 1 million for the first time since 2021, while the unemployment rate rose to 4.3% in the May-July period, up from 4.2% in the April-June period.

UK GDP fell by 0.5% in July compared with June. We continue to expect full-year 2023 GDP to be largely unchanged from 2022. Our base case remains that the UK economy will enter recession within the next 18 months.

China - There are tentative signs that China's economy may be about to rebound - but it's still too early to call.

Recent data releases on trade, inflation and credit demand weren't as dire as many had expected but China's economic challenges certainly aren't over. September's report on retail and housing sales, industrial production and fixed asset investment will help paint a clearer picture on China's economic trajectory.

Official government purchasing managers' indexes (PMIs) showed that the manufacturing sector continued to contract, while growth in services slowed. Exports fell by 8.8% in August after a 14.5% drop in July, while imports were down by 7.3%, compared with a 12.4% year-on-year decrease in July.

Following July's deflationary data, when broad consumer prices fell on a year-on-year basis, August saw consumer prices rise by 0.1% year-on-year and by 0.3% month-on-month. Vanguard expects headline inflation of 0.5%-1.0% for the full year.

We maintain our forecast for full-year economic growth in a range of 5.25%-5.75%.

The points above represent the house view of the Vanguard Investment Strategy Group's (ISG's) global economics and markets team as at 14 September 2023.

Asset-class return outlook

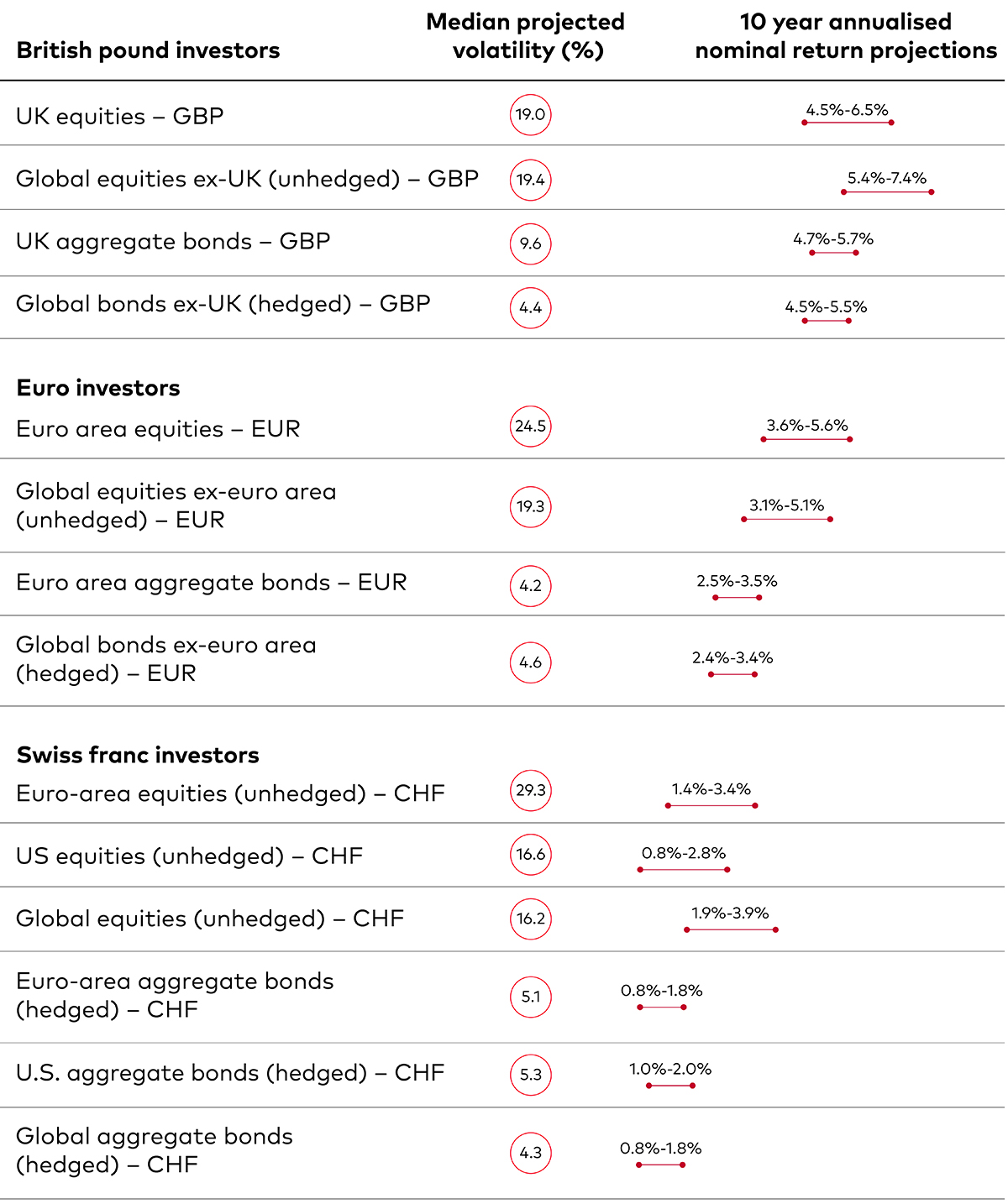

Vanguard's 10-year annualised outlooks for equity and fixed income returns are unchanged since the August 2023 economic and market update and are based on a 30 June 2023 running of the Vanguard Capital Markets Model® (VCMM).

Our 10-year annualised nominal return projections, expressed for local investors in local currencies, are as follows2.

1 The terminal rate is our view of the level at which central bank policy rates will peak during their interest rate tightening cycle.

2 The figures are based on a 2-point range around the 50th percentile of the distribution of return outcomes for equities and a 1-point range around the 50th percentile for fixed income. Numbers in parentheses reflect median volatility.

IMPORTANT: The projections or other information generated by the Vanguard Capital Markets Model regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Distribution of return outcomes from the VCMM are derived from 10,000 simulations for each modeled asset class. Simulations are as of 30 June, 2023. Results from the model may vary with each use and over time.

Webinar: Quarterly investment outlook

Watch this webinar on demand to hear from our economists on the latest macroeconomic data and trends with an eye on the months ahead.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results.

IMPORTANT: The projections and other information generated by the Vanguard Capital Markets Model regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. VCMM results will vary with each use and over time.

The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model® is a proprietary financial simulation tool developed and maintained by Vanguard's primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include US and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, U.S. money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

Important information

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained in this article is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this article does not constitute legal, tax, or investment advice. You must not, therefore, rely on the content of this article when making any investment decisions.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2023 Vanguard Group (Ireland) Limited. All rights reserved.

© 2023 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2023 Vanguard Asset Management, Limited. All rights reserved.