Highlights

- Slowing inflation and a more dovish narrative from US policymakers led investors to begin pricing in interest rate cuts in 2024, putting pressure on bond yields.

- Government bond yields fell over the month, as yield curves inverted further. 10-year US Treasury yields saw their largest monthly decline since July 2021.

- In credit markets, investment-grade and high-yield spreads tightened.

Bond markets moved higher in November as signs of slowing inflation and more dovish comments from the US Federal Reserve (Fed) led to a positive shift in sentiment. Investors began pricing in interest rate cuts in 2024, putting downward pressure on government bond yields, with 10-year US Treasury yields posting their largest monthly decline since July 2021.

The US economy continued to show signs of resilience, with GDP growth being revised upwards to 5.2% from initial estimates of 4.9%. Headline and core inflation in the US slowed to 3.2% and 4%, respectively, due to lower petrol prices and a slowdown in the housing market. A similar inflation story unfolded in the UK and Continental Europe, with headline inflation falling to 4.6% in the UK (the lowest level in two years) and to 2.4% in the euro area.

In the US, policymakers indicated they would consider cutting interest rates if inflation continued to decline, marking a significant change in sentiment away from the central bank's previous ‘higher-for-longer' narrative. However, some Fed policymakers continued to emphasise a focus on data dependence in driving policy decisions.

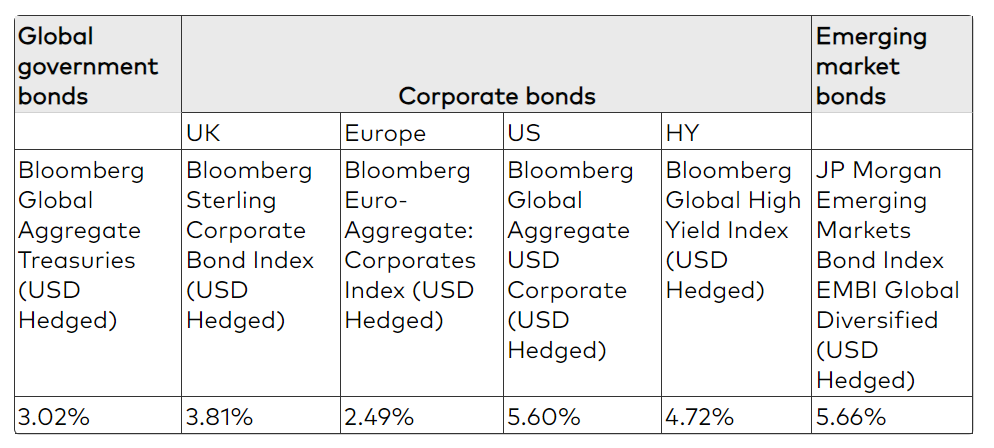

Monthly performance by market

Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Source: Bloomberg; for the period 31 October 2023 to 30 November 2023. Bloomberg indices are used as proxies for each exposure.

Government bonds

Developed market government bond yields broadly fell over the month, as yield curves inverted further. In the US, 2-year and 10-year yields fell by 41 basis points (bps) and 60 bps, respectively. In Europe, German 2-year Bund yields fell by 20 bps, while 10-year Bund yields fell by 36 bps. In the UK, 2-year and 10-year gilt yields fell by 17 bps and 34 bps, respectively1.

Credit markets

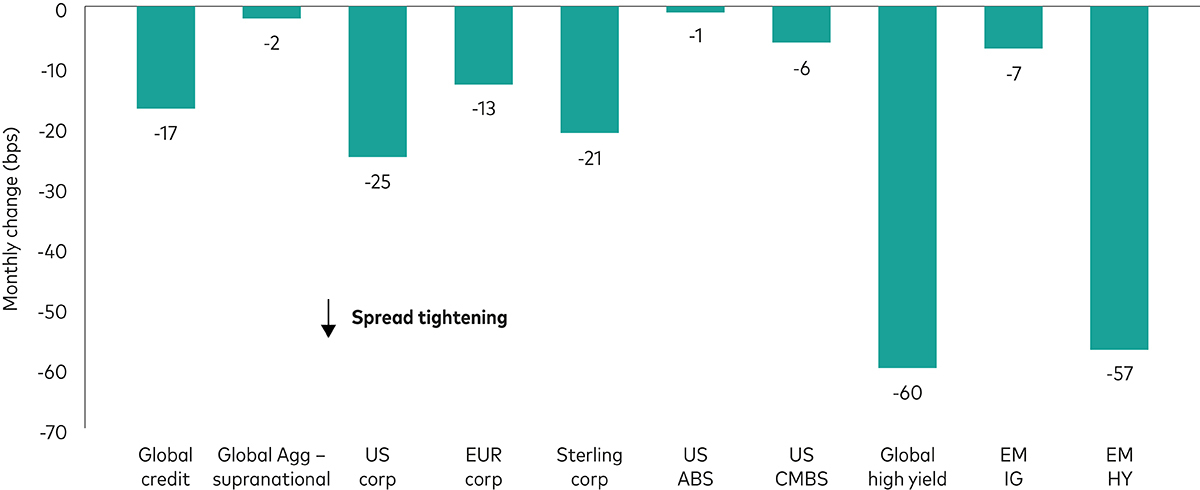

In credit markets, investment-grade and high-yield spreads broadly tightened in November, with investment-grade spreads in the US, UK and euro area tightening by 25 bps, 21 bps and 13bps, respectively2. Global high-yield spreads saw the most compression, tightening by 60 bps3. In emerging markets (EM), investment-grade and high-yield spreads also tightened, by 7 bps and 57 bps respectively4.

Changes in spreads

Source: Bloomberg indices: Global Aggregate Credit Average OAS Index, Global Aggregate Supranational Index, US Aggregate Corporate Average OAS Index, Euro Aggregate Corporate Average OAS Index, Sterling Aggregate Corporate Average OAS Index, US Aggregate ABS Average OAS Index, US Aggregate CMBS Average OAS Index, Global High Yield Average OAS Index, JP Morgan EMBI Global Diversified IG Sovereign Spread Index, JP Morgan EMBI Global Diversified HY Sovereign Spread Index. Data for the period 31 October 2023 to 30 November 2023.

Third-quarter corporate earnings came in largely in line with expectations. A low double-digit year-on-year decline in earnings was primarily due to a challenging comparison period. There was a large variation in earnings results between sectors. Earnings surprises were slightly better than the long-term average, with financials and utilities among the sectors reporting to the upside. Weaker-than-expected sectors included technology, consumer discretionary (in particular, carmakers and luxury goods manufacturers), which we view as confirmation of a weakening economic backdrop.

Despite these headwinds, investment-grade corporates are entering the recessionary environment with stronger balance sheets than in previous downturns. With the exception of certain sectors (such as real estate), many companies have deleveraged over the past few years and are now more strongly positioned in their leverage and interest coverage metrics than before the Covid-19 pandemic. In our view, credit spreads reflect the expected economic slowdown.

Emerging markets

EM credit markets rallied in November, returning 5.7%. Weaker-than-expected US growth and inflation data led credit markets to price out further Fed hikes in this cycle, precipitating a broader rally across EM credit sectors and in US Treasuries. As a result, the EM credit rally benefitted from both excess return (1.7%) and Treasury return (3.9%) in November5.

EM investment-grade returns (5.5%) were driven primarily by US Treasury returns (4.6%), with US 10-year yields rallying 60 bps over the month6. High-yield returns (5.8%) benefitted from a resurgence in risk appetite, accounting for 58 bps of spread compression during the month7. Amid the broad rally, some idiosyncratic returns stood out, including a 29% gain in Argentinian sovereign bonds8. EM local bonds also performed well in November, rallying 5.2%9. EM currencies gained 2.6% against the US dollar as markets priced in expectations of the end of the Fed hiking cycle.

Outlook

We remain positive in our outlook for investment-grade bonds, supported by higher starting yields, a Fed that is probably near the end of its hiking cycle and a global economy that is weaker but not yet recessionary. Slowing growth and weakening inflation are providing strong tailwinds for adding duration in high-quality areas of credit. If recession hits, lower-quality credit sectors are likely to underperform, though yields at current levels are likely to offset some of the spread widening. We maintain our view that corporate bond yields are extremely attractive at current levels and, broadly speaking, yields at these levels have historically been followed by strong returns over the next six to 12 months.

In EM credit, EM investment-grade bonds should remain defensive in a more challenging macroeconomic environment, but large segments of the market look expensive from a spread perspective. EM investment-grade sovereigns should react well to a calming in the US Treasury market, absorbing much of the stress if US growth weakens. Currently, we see limited value in EM investment-grade credit, where spreads have compressed for much of the year and is trading through its fair value range relative to US investment-grade credit. EM high-yield debt has performed well this year, although valuations and spreads are now looking tight. However, there are pockets of value in certain distressed countries and capital structures.

Further out, we are constructive on EM credit given the high overall yields, a relatively supportive technical backdrop and the prospect of a return of flows into the asset class. We expect return dispersion across EM credit to increase, generating opportunities to add value with fundamental analysis and security selection.

1 Data for 2-year and 10-year yields for US Treasuries, German Bunds and UK gilts are from Bloomberg; for the period 31 October 2023 to 30 November 2023.

2 Source: Bloomberg Global Aggregate Credit Index, 31 October 2023 to 30 November 2023.

3 Source: Bloomberg Global High Yield OAS Index, 31 October 2023 to 30 November 2023.

4 Source: JP Morgan EMBI Global Diversified Index, 31 October 2023 to 30 November 2023.

5 Source: Bloomberg, JP Morgan, with Vanguard calculations; for the period 31 October 2023 to 30 November 2023.

6 Source: Bloomberg, JP Morgan, with Vanguard calculations; for the period 31 October 2023 to 30 November 2023.

7 Source: Vanguard and JP Morgan. Calculations for the period 31 October to 30 November 2023.

8 Source: JP Morgan EMBI Global Diversified Index; 31 October 2023 to 30 November 2023.

9 Source: JP Morgan EMBI Global Diversified Index, 31 October 2023 to 30 November 2023.

Our most popular funds in December

Vanguard active bond funds

Giving bond investors the best chance of investment success.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results.

Some funds invest in emerging markets which can be more volatile than more established markets. As a result the value of your investment may rise or fall.

Funds investing in fixed interest securities carry the risk of default on repayment and erosion of the capital value of your investment and the level of income may fluctuate. Movements in interest rates are likely to affect the capital value of fixed interest securities. Corporate bonds may provide higher yields but as such may carry greater credit risk increasing the risk of default on repayment and erosion of the capital value of your investment. The level of income may fluctuate and movements in interest rates are likely to affect the capital value of bonds.

Reference in this document to specific securities should not be construed as a recommendation to buy or sell these securities, but is included for the purposes of illustration only.

Important information

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained in this document is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document does not constitute legal, tax, or investment advice. You must not, therefore, rely on the content of this document when making any investment decisions.

The information contained in this document is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2023 Vanguard Group (Ireland) Limited. All rights reserved.

© 2023 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2023 Vanguard Asset Management, Limited. All rights reserved.