Highlights

- The higher interest rate environment will last years, not months.

- The regime-shift towards higher rates is likely to have profound implications for households, businesses and governments.

- The higher-for-longer rate outlook is a boost for long-term, risk-adjusted returns for well-diversified portfolios.

The transition to a higher interest rate environment represents the single most important financial development since the 2008 global financial crisis (GFC) - that's the key takeaway from Vanguard's economic and market outlook for 2024.

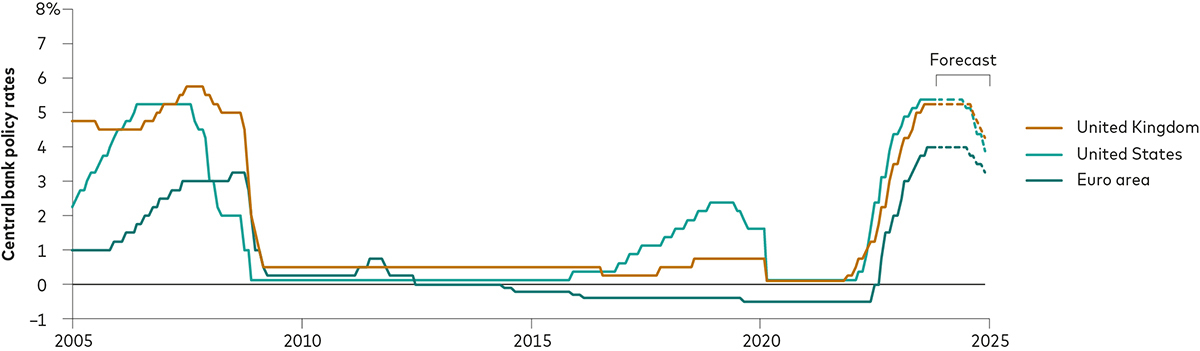

While interest rates are expected to fall from their peaks in the second half of 2024, in the years ahead Vanguard expects central banks' policy rates to settle at a higher level than we've grown accustomed to.

In short, zero interest rates are yesterday's news.

Fading economic resilience and rate cuts in 2024

After nearly two years of steady interest rate hikes in most developed markets and with inflation falling back from generational highs, we expect central banks' policy rates to remain near their current levels in the first half of 2024 before receding.

With inflation falling towards central banks' targets across most major developed markets, monetary policy will likely become increasingly restrictive in real terms. The resilience that global economies exhibited through much of 2023 is likely to fade as the effects of Covid-19-era expansive fiscal policy and excess savings diminish.

We expect the US to slip into recession in late 2024, while the euro area may already be in a recession and the UK economy is close behind - with recession or at least below-trend growth expected in the months ahead.

This economic slowdown, coupled with inflation falling to target, gives us conviction that central banks will start to ease policy in the second half of 2024. In our base case, we expect rate cuts of 75 basis points in the euro area and between 150 and 200 basis points in the US next year.

A return to ultra-low interest rates is unlikely, however. By the end of 2025, we expect policy rates to be between 2.25% and 3.75% across major developed markets. We're not returning to a zero-interest rate world anytime soon, and this will have profound implications for the global economy and financial markets.

Policy rates likely to be cut but remain elevated

Source: Vanguard calculations, based on data from Bloomberg, as at 30 November 2023.

Notes: Monthly data are from January 2005 to November 2023. Forecasts thereafter run to year-end 2024.

Higher rates for years, not months

Over the next 10 years, interest rates in developed markets are likely to remain above pre-pandemic levels in a structural shift related to the rise in the equilibrium real interest rate - also known as the neutral rate, r-star, or r*. This is the theoretical interest rate at which monetary policy would neither stimulate nor restrict an economy. Described another way, the neutral rate is the balancing point between savings and investments in an economy.

Vanguard research suggests r-star has increased in the US by about 100 basis points—or 1 percentage point—since 2008 to around 1.5% today, making the nominal interest rate around 3.5%. The pattern exists across other developed markets including the euro area, UK, Australia, Japan and Canada. Every country has its own dynamics, so the changes occur at different rates, but we calculate an increase of roughly 1 percentage point in equilibrium real interest rates since the GFC.

There are two important drivers for this higher equilibrium rate: demographics and higher structural government deficits. As people age and retire, accumulated savings are spent and the size of the working-age population shrinks. On the other side, governments borrow to finance infrastructure and other long-term needs. So, as fewer people are saving and more are borrowing, interest rates will rise.

This higher interest rate environment will last not months, but years - marking a structural shift that will endure beyond the next business cycle. Indeed, by the end of 2025, we expect policy rates to be between 2.25% and 3.75% across major developed markets.

We're not returning to a zero-interest rate world and this will have profound implications for the global economy and financial markets.

A solid foundation for long-term risk-adjusted returns

The regime-shift towards higher rates is likely to have profound implications for households, businesses and governments. For households, higher rates will encourage saving and more prudent consumption behaviour. For business, higher borrowing costs will ensure capital is allocated more judiciously to the most productive and profitable projects. For governments, higher rates will force a reassessment of fiscal policy—rising debt has become an issue that must be tackled by this generation, not the next.

For well-diversified investors, the permanence of higher real interest rates provides a solid foundation for long-term risk-adjusted returns. However, as the transition to higher rates is not yet complete, near-term financial market volatility is likely to remain elevated.

Read the full report to find out how our long-term asset return expectations have changed, including for multi-asset portfolios.

Watch the Vanguard economic and market outlook for 2024 webinar for further insights, including a Q&A with Vanguard economists.

Vanguard economic and market outlook 2024

Our 2024 outlook report is available now.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained in this document is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document does not constitute legal, tax, or investment advice. You must not, therefore, rely on the content of this document when making any investment decisions.

The information contained in this document is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2023 Vanguard Group (Ireland) Limited. All rights reserved.

© 2023 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2023 Vanguard Asset Management, Limited. All rights reserved.