According to Quilter's latest survey, more than half of advisers - 54% - would like to increase the number of customers they serve. That's not a particularly surprising finding; after all, successfully onboarding new clients drives revenue. With that sort of appetite, you could be forgiven for thinking the "advice gap" - the gulf between the number of people who need advice and the number who receive it - would be shrinking.

Sadly, the reverse is true. The most recent Open Money survey found that fewer people than ever are taking paid financial advice[1]. Just one in fourteen people has paid for advice in the last two years, compared to one in 10 in the previous year's survey. So, why, given that advisers want to serve more customers, are we heading in the wrong direction?

The answer appears to lie in the working time constraints of the adviser. Let's take a look at the maths. We have 52 weeks in a year, with around four used as holiday - give or take a bit - and a further 8 public holidays. Call it roughly 46 working weeks, each consisting of 5 days, with those days made up of 8 working hours. That means the typical adviser works approximately 1,840 hours a year.

Many advisers reading that calculation might well think "If only" - particularly in light of the need to meet important clients at their convenience and outside what many consider to be "normal" working hours. Putting that to one side, the point is that there are a finite number of working hours: like the rest of the human race, advisers don't get to be in two places at once.

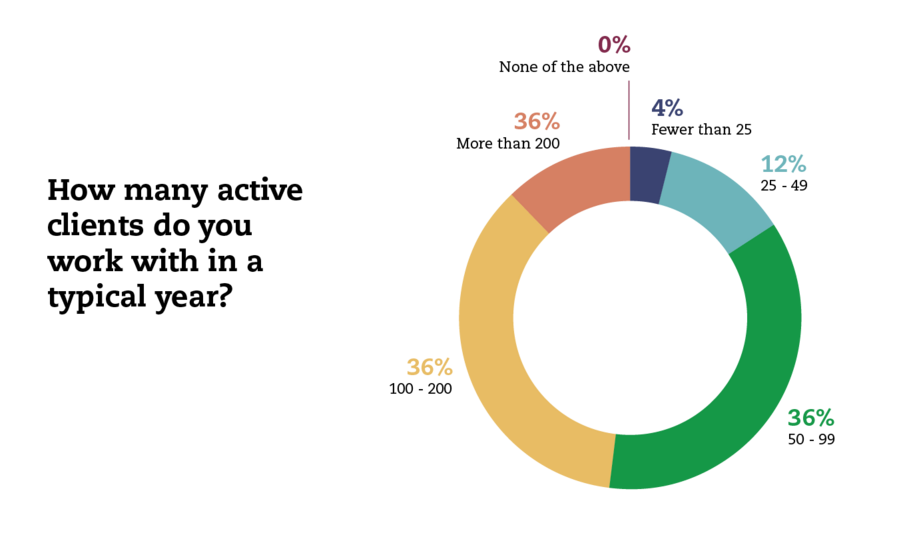

This places a physical constraint, a hard limit, on the number of clients that can be served. According to our survey, that appears to be somewhere between 50 and 200 clients a year. Given that we've asked advisers to tick a box showing a ranged answer (e.g. 35-49) its difficult to work out an absolute average number of clients, but it looks to be around 100. Going back to our number of working hours - 1,840 - that means that the "average" customer is getting around 18 hours of dedicated time a year. Two and a bit working days. And of course, it has to be considered that not all clients are equal in terms of AUA (Assets Under Advice).

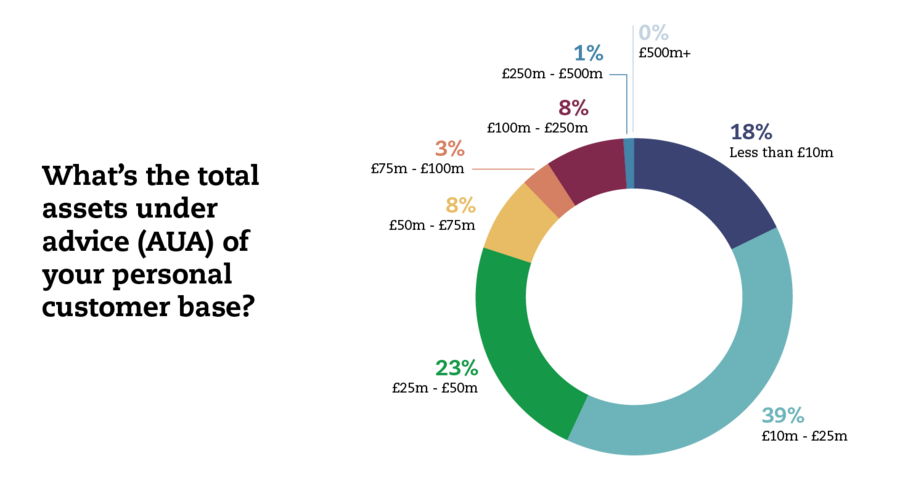

Clients of course, are not going to get an equal 18 hours each. There is inevitably more work to do for clients with larger portfolios and more complex challenges - and more fees to be earned in the process. Many advisers will be impacted by the Pareto Principle[2] - roughly speaking that 20% of your client base account for 80% of your revenue. With maths like this, advisers could be forgiven for focusing on the high value clients who can be served efficiently - and who are likely through their wealth to value the adviser's service most highly. Inevitably, and through no fault of the adviser, this can lead to a focus on the well-heeled.

Can advisers help close the advice gap?

On these numbers, arguably not. Indeed its possible to make a coherent case that there is a zero sum game[3] in play. The is a finite number of advisers with a finite number of working hours, which imposes a finite limit on the number of clients they can serve. No amount of pressure on advisers is going to result in them re-engineering their business model in way that makes it less profitable - asking people to take a pay cut is never going to be popular. So where now for the advice gap?

There's two ways we can go from here:

- Increase the total number of advisers

- Make the business of advice more efficient - reduce the hours spent on "non-advice" tasks like compliance and admin

At Quilter, we like to think we're making strides with both: training the next generation of advisers in the Quilter Financial Adviser School, and providing efficient platforms and compliance and administration solutions to advisers across the UK - solutions that free up working time so that advisers can focus on what they best: serving their customers.

It naturally takes time for budding advisers to gain qualifications and get the experience needed to start to bridge the advice gap so in the short term the best tool we have is helping to streamline the advice process. By providing tools to our valued advisers which help them concentrate on their clients we can buy time for the new guard of advisers to cut their teeth and ultimately work towards ensuring as many people as possible in the UK unlock the value of advice.