The importance of active management

It's been a volatile year for financial markets as recessionary fears, tighter policy, geopolitical tensions and uncertainty around UK macro policy have led to extreme market moves and the worst start to the year for global stocks since 2008. The post covid boom looks certain to end in a recessionary bust, with central banks aggressively raising interest rates to control inflation. We believe this challenging environment will once again underline the importance of active management.

Dangers of a passive approach

Whilst a simple passive approach may have been appropriate at times when all asset classes were performing positively, in any other circumstances, these funds have their dangers.

We use active management in our multi-asset portfolios to add value, by tactically adjusting exposure towards more attractive asset classes as the business cycle evolves.

Asset performance can differ sharply from year to year, especially heading into and out of recessions. The ability to adjust exposure, rather than following the benchmark passively, forever topping back up on poorly performing investments, is particularly important in times of volatility.

This has been particularly evident this year where both stocks and bonds have fallen sharply, leading passive balanced funds to have their worst returns in over 50 years. 1

Our active management approach - tactical asset allocation

Our tactical asset allocation process is grounded in quantitative analysis, but implemented allowing for the expertise, experience, and judgement of a 13-strong team with, on average, 17 years of investment experience. On a daily basis the team reviews trades suggested by the research process, adding qualitative information about what may be different this time and how we should position the multi-asset portfolios we manage.

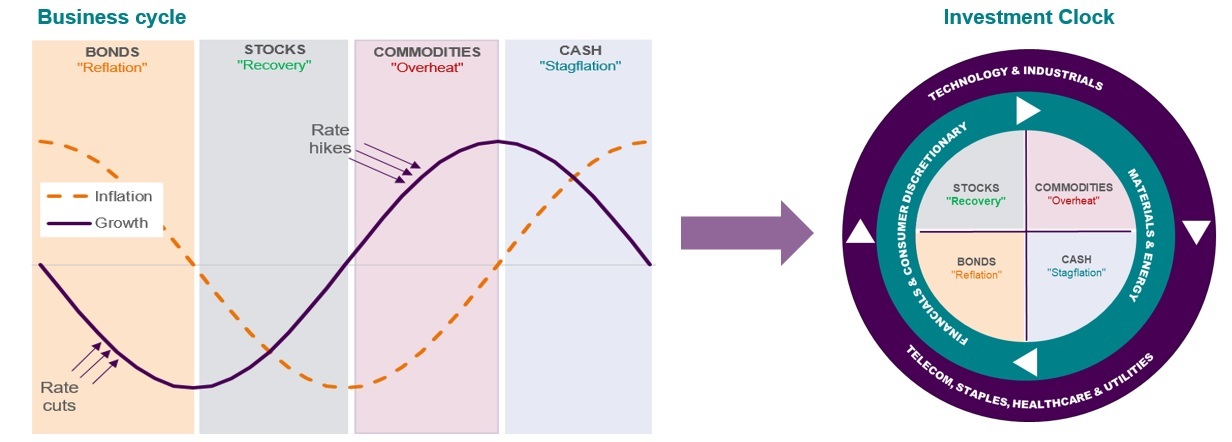

The Investment Clock is one model used by the team to guide its decisions, including allocations to equity, fixed income, and commodities, as well as guiding exposure to different equity sectors.

The concept of positioning investments around a clock face representing the business cycle can trace its history back to 1937. Our insight is to understand that trends in global growth and inflation can help you to tell the time on the Clock. This allows you to judge which investments are likely to do best in what comes next.

Chart 1: Phases of the business cycle and the Investment Clock

Source: RLAM. For illustrative purposes only.

We split the business cycle into four phases, depending on the strength of growth and the direction of inflation, and link each phase with an asset class that we expect to do well at that time:

- ‘Reflation' is defined by weak growth and falling inflation. Central banks cut rates and bonds should do well.

- ‘Recovery' starts when monetary stimulus takes effect. Growth and profits rebound, but spare capacity keeps inflation low and policy loose. Stocks should do best.

- In ‘Overheat', growth and inflation are rising and central banks hike rates. Commodity prices should be strong.

- ‘Stagflation' is when growth slows but inflation continues to rise, like a hangover after the party. Cash should be attractive.

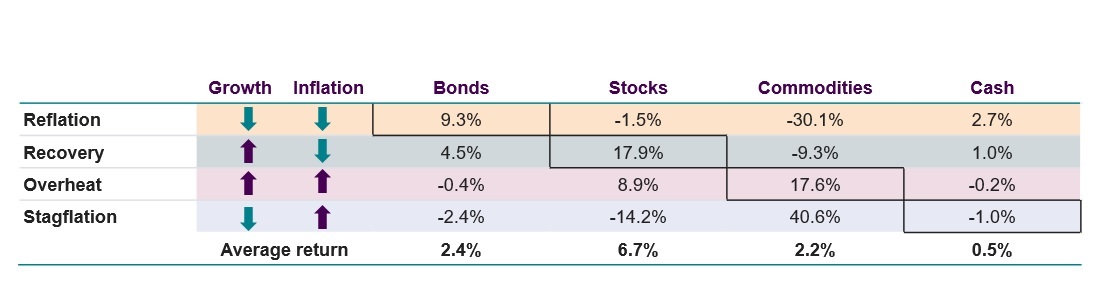

We use the benefit of hindsight to identify the four phases of the cycle in the US economy since the 1970s. An analysis of returns supports the intuition with bonds doing best in Reflation, stocks in Recovery and commodities in Overheat.

Cash offers capital protection in Stagflation (although most episodes have been linked to geopolitical events, like the Ukraine war, which have been beneficial for commodities).

We have spent most of 2022 in Stagflation with growth slowing, inflation rising and only commodities doing well. We're expecting to move into disinflationary Reflation in 2023 with bonds doing better again.

Chart 2: Average historic returns in business cycle phases

Past performance isn't a reliable indicator of future results. Source: RLAM. For illustrative purposes only. Data based on an analysis of business cycles from April 1973 to June 2022. Figures are shown in real terms.

Other models

In addition to the Investment Clock model, we have a number of other robust models which we use to guide our tactical asset allocation decisions. These quantitative models are used in conjunction with the judgement from our team to provide a resilient, repeatable process to add value to our portfolios over time.

How all of this helps give you peace of mind

In the challenging environment ahead, active management can not only help clients navigate around poor decisions (versus passive investors that just follow the benchmark), but also seek to add incremental value over time as market opportunities arise. This gives you and your clients the comfort of a tried and tested active process that is continuously adapting as conditions change. An important factor in these volatile times.

Discover more about Royal London's multi-asset portfolios here

1 Source: Datastream, October 2022.

This post is funded by Royal London