Following a tumultuous month for the banking sector either side of the Atlantic, talk of a wider, deeper crisis unfolding for lenders has gained momentum.

The main concerns revolve around the impact of further rate hikes by central banks on the balance sheets of commercial lenders and their profitability, particularly as the yield on 3-month US Treasury bills is currently higher than that on 10-year Treasury bonds, making for an inverted yield curve.

Our analysis suggests fears of a banking sector crisis are overblown. In this article, we explain why investors should be wary of making any tactical calls on one of the core sectors of the global economy.

The interest rate concern

One key measure of bank profitability is the net interest margin (NIM). The NIM is the interest a bank earns on the loans it makes minus the interest it pays on deposits held at the bank.

Banks typically accept funds in the way of short-term deposits from those with current surpluses and make long-term loans to those in need (known as ‘maturity transformation'). Conventional wisdom is that banks benefit from a steep yield curve, when the rate they receive on long-term loans is much greater than what they pay on short-term deposits1.

So, in light of the inverted yield curve we see today, there is a concern that further rate hikes might be a headwind for bank balance sheets. However, history has shown that NIMs have not only moved higher with a steeper yield curve, but also as a result of higher short-term rates.

The question, then, is what does today's environment of high rates, but an inverted yield curve, mean for bank profitability?

Why rising rates are typically good for bank profitability

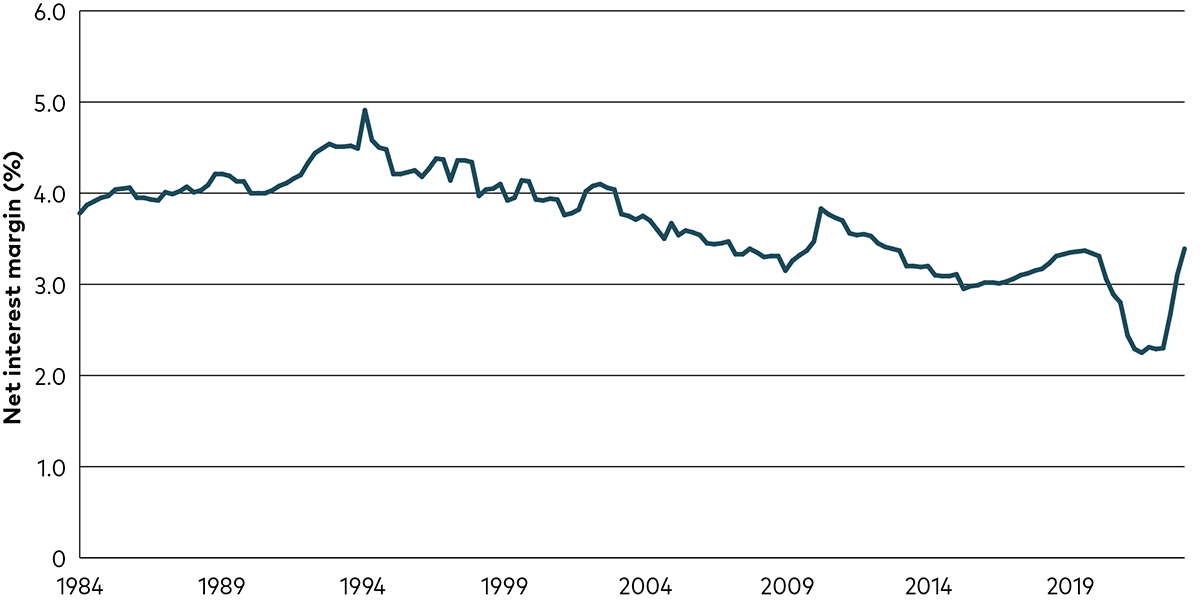

We analysed the aggregate NIM for US banks since 1984 and found a downward trend coinciding with the ultra-low interest rate period that began in 2010, reaching a historic low at the beginning of 20212. As the first chart below shows, this trend then reversed as the US Federal Reserve raised short-term rates throughout 2022, bringing US aggregate NIM back up to pre-pandemic levels.

Other factors may have contributed to a decreasing NIM for US banks since the 1980s, including tighter regulation, increased competition and a changing liability mix, but in this research we focused on the effect of the prevailing interest rate and yield environment.

Historical US banks aggregate NIM

Source: Vanguard calculations based on data from Federal Financial Institutions Examination Council and Federal Reserve Bank of St Louis, retrieved from FRED. Quarterly data between January 1984 and October 2022. Notes: The official NIM data series was discontinued in Q3 2020; after that point NIM has been estimated based on data for banks' earning assets and income, via their historical relationship with NIM.

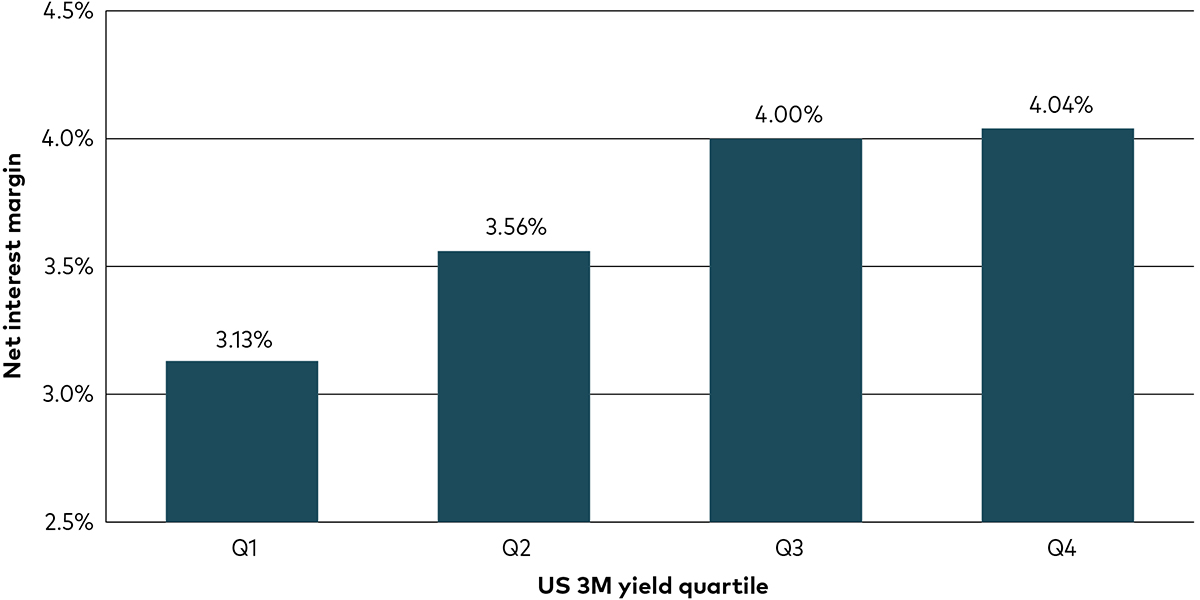

As the next chart shows, a positive relationship exists between short-term yields (3-month Treasuries) and NIM for the lowest three quartiles of historic short-term yields (since 1984), meaning rising short-term rates have generally coincided with greater profitability for banks. However, this positive relationship reaches a point of saturation when approaching the highest quartile of historical short-term yields.

Higher central bank rates lead to greater NIM

Source: Vanguard calculations based on data from Federal Financial Institutions Examination Council and Federal Reserve Bank of St Louis, retrieved from FRED. Quarterly data between January 1984 and October 2022. Notes: The official NIM data series was discontinued in Q3 2020; after that point NIM has been estimated based on data for banks' earning assets and income, via their historical relationship with NIM.

One reason for the levelling-off of bank profits might be that when rates reach the highest quartile, and are close to a peak, banks start reducing the amount of loans they make due to increasing credit risks, whilst demand also decreases as the cost of borrowing continues to rise. Further, on the deposits side, pricing catches up with higher rates leading to a squeeze on funding costs. Therefore, from a historical perspective, once short-term yields pass a certain point, bank profitability plateaus.

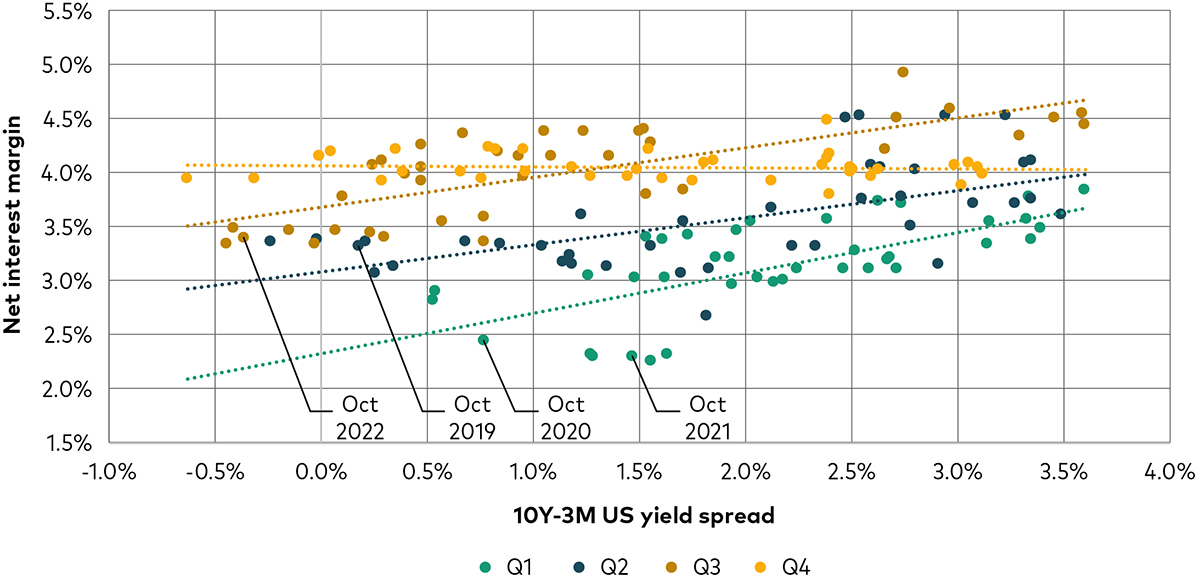

A similar pattern was observed when we looked at the impact on aggregate US NIM relative to the spread between 3-month and 10-year US Treasuries3. The next chart illustrates this point, whereby, within each quartile of short-term yields, the larger the spread, the higher the NIM. However, when short-term yields are in the highest quartile, spread widening doesn't lead to yet greater profitability.

One explanation as to why NIM plateaus before spreads reach their widest point could be that banks are unwilling (or unable) to charge the higher rates on long-term loans, which are commensurate with a steeper yield curve, given short-term yields are already so high.

Wider spreads tend to boost bank profitability

Source: Vanguard calculations based on data from Federal Financial Institutions Examination Council and Federal Reserve Bank of St Louis, retrieved from FRED. Quarterly data between January 1984 and October 2022. Notes: The official NIM data series was discontinued in Q3 2020; after that point NIM has been estimated based on data for banks' earning assets and income, via their historical relationship with NIM.

Even with an inverted yield curve, the aggregate NIM for US banks as of October 2022 (the most recent available data) was higher than in each of the previous three years, when the yield curve followed a more typical, upward sloping trajectory. From today, if spreads were to widen further, or rates to move higher, then it's likely to be a tailwind to profitability.

In short, higher short-term rates set by central banks and wider spreads are generally good news for bank NIMs - until rates are close to peak and profitability saturates. So if rates do continue to rise this year - in line with market expectations (and Vanguard's view) - we see no reason to expect bank profitability to suffer.

If central banks begin to cut rates later this year - a scenario that markets are pricing in - bank profitability would likely face headwinds, but this would be happening from a position of margin strength not seen for the past few years.

Vanguard expects central banks in the US, euro area and UK to raise rates again this year and hold them at peak levels for the remainder of 2023.

The importance of maintaining a diversified portfolio

For the reasons outlined above, we don't believe there is reason to panic about clients' exposure to the global banking sector due to fears over profitability in the face of higher rates.

The stock market volatility witnessed in recent weeks was a reminder of the risk-reducing benefits of maintaining a globally diversified portfolio, while the analysis we share in this article supports the case for maintaining an allocation to a broad cross-section of the global banking sector as part of a diversified strategy across all sectors.

This post is funded by Vanguard

1 See ‘What is the Impact of a Low Interest Rate Environment on Bank Profitability?', July 2014, Genay, H. and Podjasek, R., Chicago Fed Letter No.324.

2 Source: Vanguard calculations based on data from Federal Financial Institutions Examination Council and Federal Reserve Bank of St Louis, retrieved from FRED. Quarterly data between January 1984 and October 2022. See also ‘Why are Net Interest Margins of Large Banks So Compressed', October 2015, Covas, F. B., Rezende, M. and Vojtech, C. M., FEDS Notes.

3 See ‘Low Interest Rates and Bank Profits', June 2017, Di Lucido, K., Kovner, A. and Zeller, S., Federal Reserve Bank of New York.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

This is a marketing communication.

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained in this document is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document does not constitute legal, tax, or investment advice. You must not, therefore, rely on the content of this document when making any investment decisions.

The information contained in this document is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2023 Vanguard Group (Ireland) Limited. All rights reserved.

© 2023 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2023 Vanguard Asset Management, Limited. All rights reserved.